What would that mean for a new Libyan cement investment project to be built in Nalut?

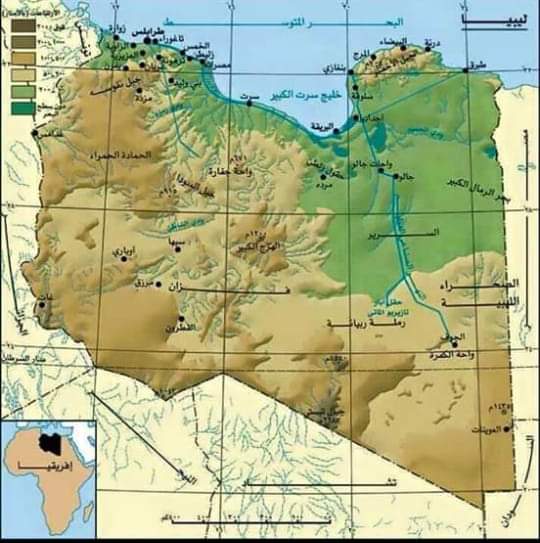

Mr. Faiez Mustafa Sarraj, the President of the Presidency Council of the Government of National Accord initialized an infrastructure programme because of robust housing demand, seeks for an instant growth in construction, so the government is calling for the cement industry to increase its capacity. The Libyan Minister of Economy Ali Al-Essawi announced that the ministry is going to support private Libyan companies to start recovering of Libya infrastructure. This announcement has been used by the Mayor of Nalut, Dr. Adel Suliman Askar as he gave strong support to ALHEDAB Co. for incorporating n investment company to setup a new Greenfield Cement Plant Project (GCPP) in the region of Nalut.

The target of this new investment project means not only setting up a new cement plant, but also to strengthen the local economy around the area of Nalut as well as getting a comfortable OFF TAKE agreement in order to export 60% of all manufactured cement from the new plant, what is basically very important for the investing companies and organisations concerning refund security of invested Capex.

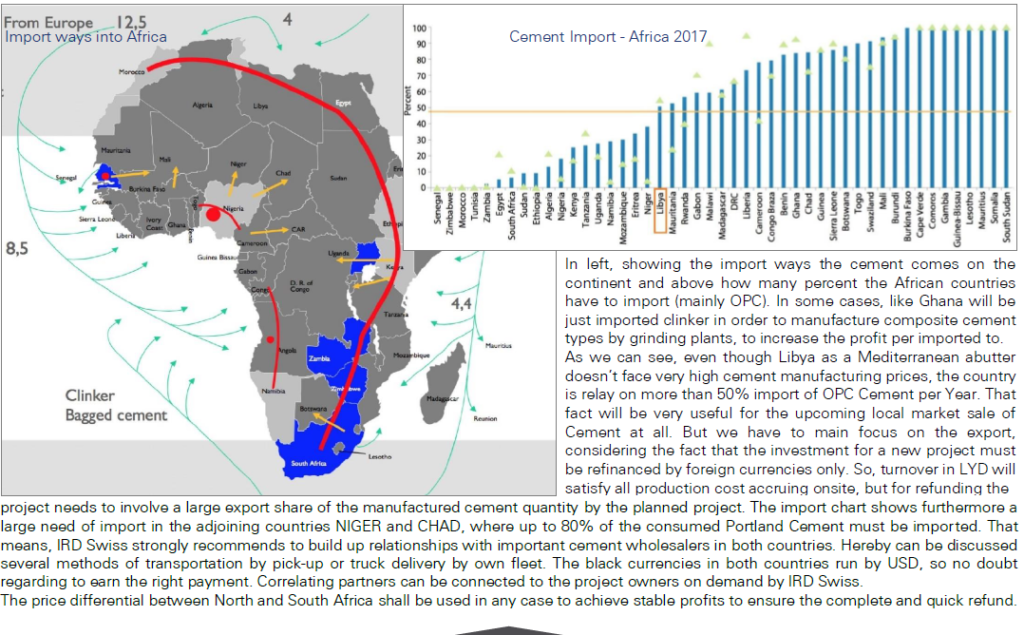

The hard currency shortage of Libyan’s economy needs to remove all cement imports to be purchased in Euro or US Dollar, independent on the fact, that some special cement to be imported, needed for some small cases in building and construction fields will remain. All manufacturers, however they are established in the domestic market, have to accept their obligation to serve the local market first before trying to export their cement products for hard currencies to foreign clients. Companies they don’t do so run the risk to be fined by the Government. On the other hand, it can be allowed in different local areas of Libya to use OFF TAKE agreements, approved by the Government, for reaching sales prices in hard currencies in order to be able to refinance their foreign investments.

In front of this well-known background has the Libyan cement manufacturer scenario a bright future, because the Libyan law won’t intervene in the National price formation at all. That means that the most modern cement plants, which can supply the market with cement in a clean and certified quality, created under clean environmental process circumstances, stable in same charging qualities and permanent controlled by European quality standards will have the best chances in market. This fact is not only a warning to older cement plant operators in Libya, but rather a chance for new project owner like ALHEDAB Cement Co. to use this unique chance to gain an exceptional market rank in a very short period of time after running-up their new plant.

Summing up all the given facts and information concerning the Libyan cement market, we have to state out that the chances for ALHEDAB Cement Co. are much higher than the risks for establishing a new cement plant facility in Libyan’s region of Nalut, where the pre-conditions being excellent because of good raw material occurrences as well as very cheap Gas and Oil prices. Easy connectivity to those available resources as well as the choice of the shareholders of ALHEDAB Cement Company to set-up a double line plant with a capacity of 2* 6000 TPD constitutes could be guaranteed success. For such a large investment shall be found for a foreign investor to become at least a shareholder of 50% of a new to be established project corporation. Finding someone of such investors is a task for IRD Swiss to get ordered as an EPC contractor, of course.

Libya has total 7 Cement plants in different Governorates and Municipalities of Libya. Those are equipped with different cement production capacities, mainly situated in the shore region as there are, Burj Cement Plant in Zliten, Al Mergheb at Khoms, Leptis Cement Plant at Khoms, Souq Al-Khamis closed to the Al-Khamis city, Zliten Cement Company at Zlithen city, Al Fataiah Cement Factory at Derna city and Benghazi-Hawari Factory at Hawari city. Except of the plant Burj Cement are belonging all other plants either to the ACC (National Cement Company) or to LCC (Libyan Cement Company)

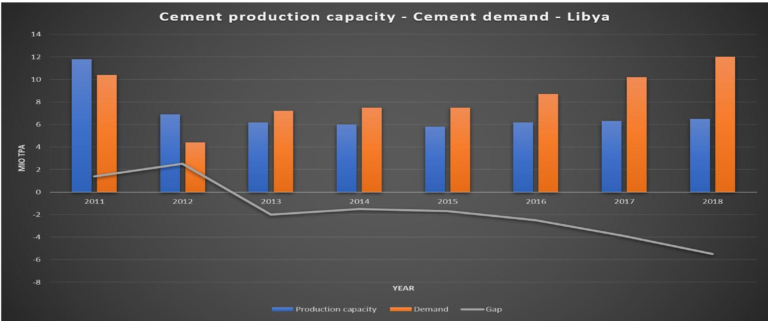

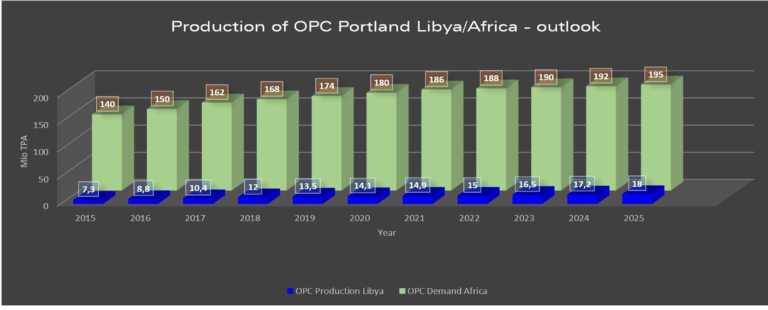

This grey table shows a significant stagnation in cement production during the last 5 years. This is no wonder because within the past couple of years no new cement facilities have been erected or introduced neither. The civil war let the country’s industry constant suffering but looking at the very significant need in cement, as announced, Libya faces a steadily increasing lack of PORTLAND™ cement currently and for near future as well. The stronger upcoming demand of qualified and certified Cement for Libyan construction and building industry market will lead into a direct growing gap between the local cement manufacturing capacity and a future demand of cement for the National market. Already now has Libya to import cement and clinker from other world suppliers in order to fulfil the requirements of constructing industry. According the Ministry of Economy shall be lifted up the cement production capacity to 20 Mio TPA until 2022 at least. That means a rate-up of about 25% in comparison to the year 2018 must be produced to fulfil the high demand on construction concrete not only in Libya, but in entire Africa as well. Even as a matter of fact, Libya as a strategic well-situated country in the middle of Northern Africa’s coast has very good export chances and conditions in upcoming Years.

Even though Libya belongs to the world’s ancient cement manufacturers, suffers its own manufacturing growth in capacity below an insignificant technical capability to increase the cement production. One reason for that is certainly the weak financial situation in what Libya is captive because of the long-time civil war. On the other hand, Libya faces an energy growth as Oil and Natural Gas will be cheap available for generating hard currencies in order to develop the country’s infrastructure.

In front of that background there is no wonder that the Libyan Government had decided not to switch from Oil and Gas firing in power plants and cement plants to coal and Petcoke as the main burning source and fuel like in almost the other countries in Africa.

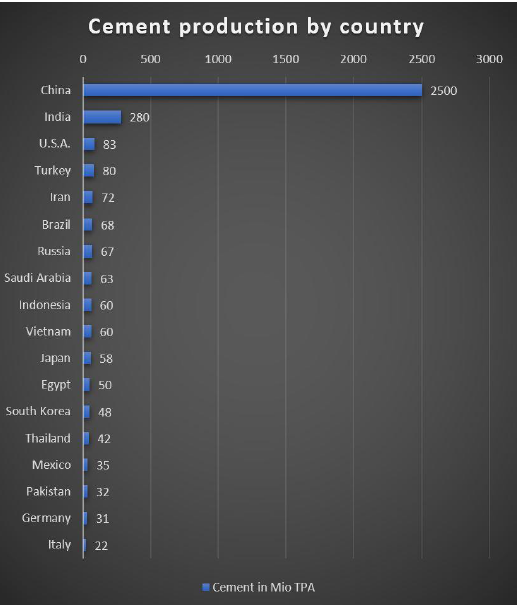

Despite is Libya concerning cement production one of the weakest cement producers in the African region and at least the smallest country in matter of cement manufacturing on that continent.

But from their National structure in industry could Libya play at the same level as Turkey does, where the cement industry plays nearly the same important role in the National economy. Turkey’s cement production has reached at the beginning of 2015 a production value of 80 Mio TPA.

A further problem, the environmental impact of the still existing and running Libyan cement plants strengthening dramatically if the cement production will be significantly increased. So there is just one direction towards a cleaner environment that requires installing high efficient filters in the cement process to avoid blowing out dust and CO2 with a lower content of pollutions.

This problem has been exacerbated extremely by using and allowing only coal as available fuel for the firing process in cement kilns in other countries. Keeping the cement plants cleaner requires the use of modern and fuel saving technical solutions paired with highest grad of efficient technical equipment and plant automation

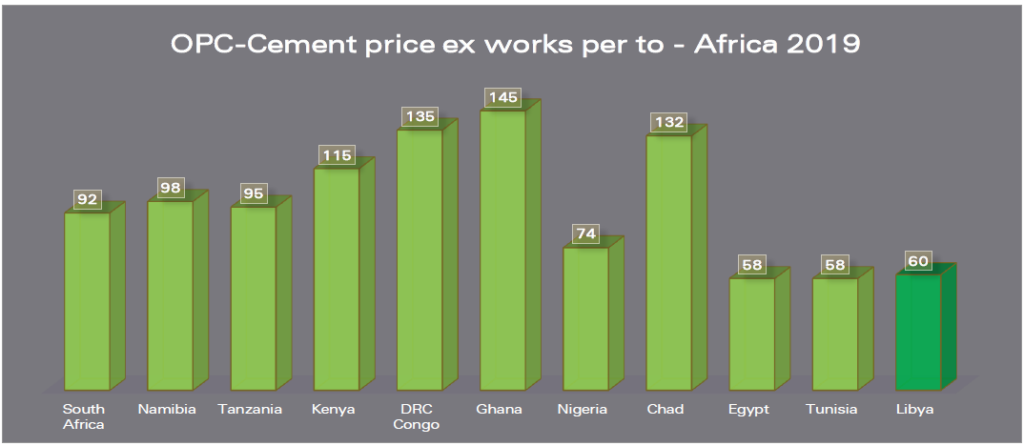

The price development on African continent within the last 5 Years was rising due to an extraordinary building and construction ordering on this booming continent. As can be seen from the above table, the prices for 1to OPC Cement is as lower as the coast of Mediterranean Sea can be reached. In middle of the continent the cement prices are at highest, because lesser producing companies mean more local demands on longer land ways to the customers. However, it is to be consider the fact, selling southwards on the continent means getting higher sales margins.

Although longer road transportations in south direction by trucks is much cost intensive than just transporting cement to the next harbour, but at the end, considering the lowest Diesel prices on the continent for Libyan forwarders, could play, earning a double of the sales price, an important fact to gain the maximized profit for the produced cement. Therefore, a separate consideration of this fact has to be done in this study by all mean.

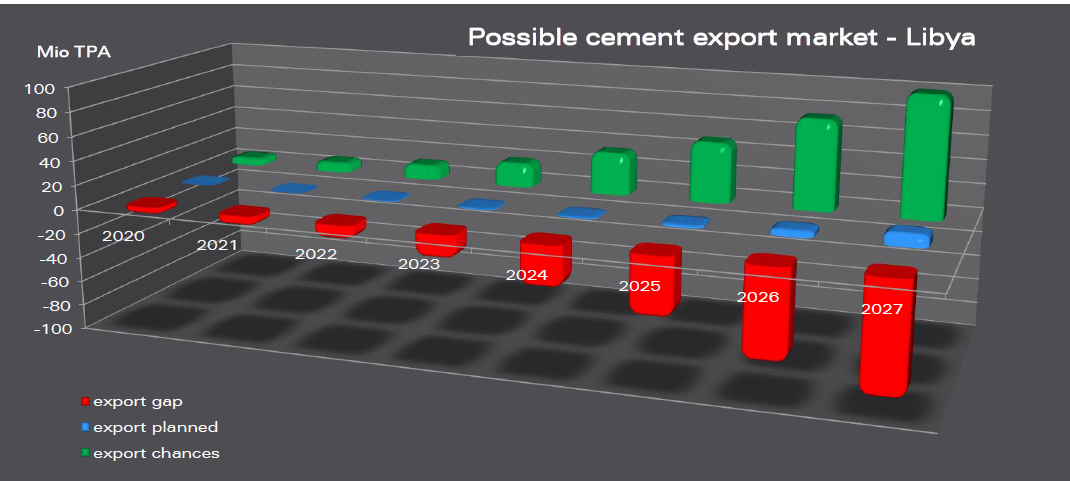

Outlook for the Libyan cement industry for exporting cement

The above diagram shows the assumed and possible figures for exporting cement to abroad markets of Libyan cement companies. There is up to 2020 no cement export known. The need to export cement is not a matter of low demand from African customers, but rather a stronger need to produce for the local Libyan market because the local market prices will increase steadily in next couple of years. That is one reason for the Government’s announcing of releasing of additional new cement licences up to the year 2022, we think. This is no doubtful decision at all. The growing local market, caused of strong rising Libyan building and construction economy, that needs to concentrate the own cement industry more than allowing exports. That is why a new cement project to be built must reach OFF TAKE agreements (60%) to export for Euro or USD currencies.